The current ratio measures the capacity of a company to pay its short-term obligations in a year or less. Analysts and investors compare the current assets of a company to its current liabilities. This tells us that Company A appears to be in better short-term financial health than Company B since its quick assets can meet its current debt obligations.

Analyzing the Debt-to-Equity (D/E) Ratio by Industry

- This is helpful in analyzing a single company over a period of time and can be used when comparing similar companies.

- These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor.

- In the banking and financial services sector, a relatively high D/E ratio is commonplace.

- A company’s accounting policies can change the calculation of its debt-to-equity.

This is in contrast to a liquidity ratio, which considers the ability to meet short-term obligations. A business that ignores debt financing entirely may be neglecting important the best inventory management software growth opportunities. The benefit of debt capital is that it allows businesses to leverage a small amount of money into a much larger sum and repay it over time.

Get in Touch With a Financial Advisor

Companies that don’t need a lot of debt to operate may have debt-to-equity ratios below 1.0. The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks. The debt-to-equity ratio is most useful when used to compare direct competitors. If a company’s D/E ratio significantly exceeds those of others in its industry, then its stock could be more risky. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds.

Effect of Debt-to-Equity Ratio on Stock Price

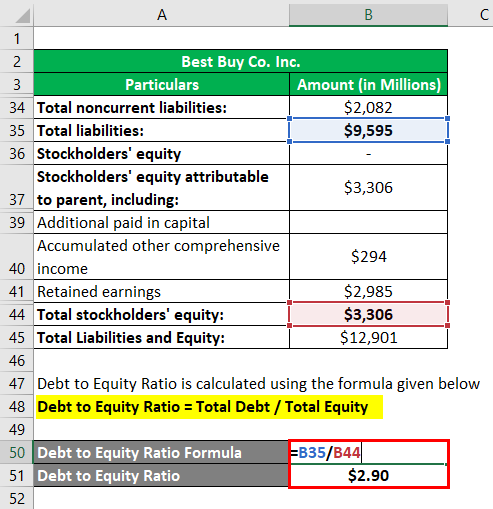

Since interest rates change over time, it can be risky to borrow in some cases. When calculating the debt-to-equity ratio, we look at the companys balance sheet, which is the financial statement of what the company owes and owns. Despite being a good measure of a company’s financial health, debt to equity ratio has some limitations that affect its effectiveness. The difference, however, is that whereas debt to asset ratio compares a company’s debt to its total assets, debt to equity ratio compares a company’s liabilities to equity (assets less liabilities).

Market data is provided solely for informational and/or educational purposes only. It is not intended as a recommendation and does not represent a solicitation or an offer to buy or sell any particular security. A high Debt to Equity ratio can lead to increased interest expenses and financial instability. Companies should aim for a balanced ratio to mitigate these risks while leveraging debt for growth.

For instance, utility companies often exhibit high D/E ratios due to their capital-intensive nature and steady income streams. These companies frequently borrow extensively, given their stable returns, making high leverage ratios a common and efficient use of capital in this slow-growth sector. Similarly, companies in the consumer staples industry tend to show higher D/E ratios for comparable reasons. A D/E ratio of 1.5 would indicate that the company has 1.5 times more debt than equity, signaling a moderate level of financial leverage.

This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. Interest payments on debt are tax-deductible, which means that the company can reduce its taxable income by deducting the interest expense from its operating income. The debt capital is given by the lender, who only receives the repayment of capital plus interest. Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders. Debt financing happens when a company raises money to finance growth and expansion through selling debt instruments to individuals or institutional investors to fund its working capital or capital expenditures. It’s also important to note that interest rate trends over time affect borrowing decisions, as low rates make debt financing more attractive.

For instance, in capital intensive industries like manufacturing, debt financing is almost always necessary to help a business grow and generate more profits. In such industries, a high debt to equity ratio is not a cause for concern. Long term liabilities are financial obligations with a maturity of more than a year. They include long-term notes payable, lines of credit, bonds, deferred tax liabilities, loans, debentures, pension obligations, and so on.

Before that, however, let’s take a moment to understand what exactly debt to equity ratio means. Lenders and investors perceive borrowers funded primarily with equity (e.g. owners’ equity, outside equity raised, retained earnings) more favorably. So, the debt-to-equity ratio of 2.0x indicates that our hypothetical company is financed with $2.00 of debt for each $1.00 of equity. While it depends on the industry, a D/E ratio below 1 is often seen as favorable. Ratios above 2 could signal that the company is heavily leveraged and might be at risk in economic downturns.

This method is stricter and more conservative since it only measures cash and cash equivalents and other liquid assets. Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest. However, if the company were to use debt financing, it could take out a loan for $1,000 at an interest rate of 5%. Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake.

As an example, the furnishings company Ethan Allen (ETD) is a competitor to Restoration Hardware. The 10-K filing for Ethan Allen, in thousands, lists total liabilities as $312,572 and total shareholders’ equity as $407,323, which results in a D/E ratio of 0.76. Put another way, if a company was liquidated and all of its debts were paid off, the remaining cash would be the total shareholders’ equity. The debt-to-equity (D/E) ratio is a metric that shows how much debt, relative to equity, a company is using to finance its operations. Debt-to-equity ratio is just one piece of the puzzle when it comes to evaluating stocks. Whether the ratio is high or low is not the bottom line of whether one should invest in a company.

Leave a Reply